US Trade Policy Update: Impacting Consumer Goods Prices by 10%

The recent shifts in US trade policy, encompassing tariffs, revised agreements, and subsidies, are poised to significantly influence consumer goods prices, with projections indicating a potential increase of up to 10% as supply chains adapt and businesses absorb new operational costs.

The intricate world of economic policy rarely remains static, and recent adjustments to US trade regulations are a prime example. As these changes filter through global supply chains, a critical question emerges: how will the US Trade Policy Update: How the Latest Changes Could Affect Consumer Goods Prices by 10% impact your wallet? This deep dive explores the potential ramifications, from manufacturing floors to checkout counters, anticipating a significant shift in consumer spending.

understanding the new trade policy landscape

The Biden administration’s approach to trade has often been characterized by a blend of continuity and strategic shifts from previous eras. While some tariffs have remained in place, others have been reconsidered, and new agreements are constantly being negotiated. This dynamic environment aims to address various objectives, from bolstering domestic industries to safeguarding national security interests.

evolution of US trade posture

For decades, US trade policy has swung between protectionism and free trade, each phase shaped by economic conditions, geopolitical realities, and evolving political philosophies. The current administration has emphasized a “worker-centric” trade policy, seeking to ensure that trade benefits broader segments of the American population rather than concentrating wealth among specific industries or corporations.

- Strategic Realignments: Focusing on critical sectors like semiconductors and renewable energy.

- Supply Chain Resilience: Efforts to reduce reliance on single-country suppliers for essential goods.

- Labor Standards: Incorporating stronger labor and environmental provisions into trade agreements.

These policy shifts are not merely theoretical; they have tangible implications for manufacturers and importers. New rules of origin, increased scrutiny on forced labor, and an emphasis on environmental compliance all translate into modified operational procedures and, potentially, higher costs. Companies must adapt to these evolving frameworks, which can include reconfiguring supply networks or investing in new technology to meet stricter standards. The cumulative effect of these changes often manifests in adjusted pricing strategies for consumer goods.

direct impact on import costs and supply chains

The most immediate and discernible effect of trade policy adjustments often materializes in the cost of imported goods. Tariffs, essentially taxes on imports, directly increase the price paid by domestic importers. When these costs rise, businesses typically face a choice: absorb the additional expense, reducing their profit margins, or pass it on to the consumer in the form of higher retail prices. Usually, it’s a combination of both, with a significant portion of the burden eventually reaching the end-user.

tariffs and their ripple effect

A recent imposition of elevated tariffs on specific categories of goods, ranging from electronics components to certain apparel items, illustrates this phenomenon. For instance, if a 10% tariff is applied to an imported product previously untaxed, the cost for the importer immediately jumps by that percentage. Given the often lean profit margins in retail, it becomes challenging for businesses to absorb such increases indefinitely without affecting consumer prices.

- Raw Material Costs: Increased tariffs on raw materials translate to higher production costs for domestic manufacturers.

- Component Pricing: Tariffs on imported components affect the final price of assembled goods.

- Finished Product Tariffs: Directly hiking the retail price of imported consumer items.

Beyond direct tariffs, changes in trade agreements can introduce new complexities. Renegotiating Free Trade Agreements (FTAs) might alter preferential access, leading to previously tariff-free goods becoming subject to duties. This forces companies to re-evaluate their sourcing strategies, potentially shifting production or procurement to countries with more favorable trade terms. Such shifts are not instant; they require planning, negotiation, and often substantial investment, contributing to a lag before the full impact is felt by consumers.

ripple effect through manufacturing and retail

The impact of trade policy extends far beyond the initial import cost. It creates a ripple effect across the entire manufacturing and retail ecosystem. Manufacturers facing higher input costs, whether from tariffs on raw materials or increased prices for komponen, must decide how to manage these expenses. This often involves a re-evaluation of production processes, seeking alternative suppliers, or, more commonly, adjusting their wholesale prices to retailers.

production cost increases and pricing strategies

When the cost of producing goods rises, manufacturers carefully analyze market demand, competition, and their own profit margins before increasing prices. They might initially absorb some of the cost to remain competitive, but this can only be sustained for a limited period. Eventually, these elevated expenses are passed along the supply chain. Retailers, in turn, receive goods at higher wholesale prices and must then factor this into their own retail pricing strategies, usually passing a portion or all of that increase to the end-consumer.

For example, a furniture manufacturer relying on imported wood or fabric will see their material costs rise if tariffs on these items increase. This higher material cost impacts the final price of a sofa or table they produce. When that furniture reaches a retail store, the store has paid more for it, and so must sell it at a higher price to maintain its own profitability. This chain reaction illustrates how changes at one point in the supply chain can cascade down to the consumer.

impact on specific consumer goods sectors

While the broad implications of trade policy are widespread, certain sectors of consumer goods are disproportionately affected. Industries with high reliance on imported components, complex global supply chains, or those facing direct competition from specific targeted regions tend to bear the brunt of policy changes more acutely. Understanding these sectoral impacts helps paint a clearer picture of where consumers might experience the most significant price adjustments.

electronics and apparel: vulnerability to trade shifts

The electronics sector, characterized by intricate global supply chains involving components from numerous countries, is particularly sensitive to trade policy alterations. Tariffs on microchips, circuit boards, or display screens, even if seemingly small, can cumulative. Likewise, the apparel industry, often dependent on textile imports and manufacturing in low-cost regions, can face considerable challenges when tariffs on finished garments or raw materials are imposed. Consumers purchasing the latest smartphone or a new set of clothes could see higher price tags as a direct result.

- Electronics: Components, assembly, and finished product pricing.

- Apparel: Raw materials (fabrics), manufacturing costs, and import duties.

- Home Goods: Furniture, appliances, and decorative items.

- Automotive Parts: Components for domestic vehicle manufacturing and aftermarket parts.

Beyond these, even seemingly domestic products can be affected if their production relies on imported machinery, specialized tools, or unique raw materials. The interconnectedness of global trade means that few industries are truly insulated from major policy shifts. Companies in these vulnerable sectors often explore strategies such as diversification of suppliers, automation to reduce labor costs, or even reshoring production, but these are long-term solutions that often come with initial cost increases, which are then passed on to consumers.

consumer purchasing power and behavioral shifts

The most direct consequence of increased consumer goods prices is a reduction in purchasing power. If a typical household’s weekly grocery bill or monthly expenditure on durable goods increases by a significant margin, their discretionary income decreases. This prompts changes in consumer behavior, as individuals and families adjust their spending habits to accommodate the new economic reality. These shifts can range from minor adjustments to substantial changes in lifestyle.

adjusting to higher prices

When facing higher prices, consumers typically adopt several strategies. Some might opt for less expensive generic brands over name brands, seek out sales and discounts more aggressively, or reduce the quantity of goods they purchase. For big-ticket items like appliances or electronics, the decision to buy might be delayed, or consumers might choose lower-spec models. This collective shift in behavior can impact overall market demand, potentially leading to lower sales volumes for businesses even as prices rise.

For example, if the price of common household cleaning supplies increases, a consumer might switch from a specific brand to a store brand, or look for multi-purpose cleaners to reduce the number of products they buy. Similarly, if clothing prices increase, they might repair old clothes more often, buy fewer new items, or opt for second-hand purchases. These micro-decisions, aggregated across millions of consumers, can have a noticeable macroeconomic impact.

mitigating factors and long-term outlook

While the immediate picture suggests potential price increases, it’s crucial to consider various mitigating factors that can temper these effects over the long term. Economic systems are complex and adaptable, and businesses, consumers, and governments often find ways to adjust to new realities. These adaptations can help to absorb some of the inflationary pressures, preventing the full projected price increase from materializing or at least spreading its impact over a longer period.

business adaptation and strategic responses

Businesses, faced with rising import costs, do not simply pass on the full burden to consumers without exploring other options. Companies often engage in robust strategies to absorb or offset these costs. This can include negotiating better deals with suppliers, optimizing their internal operations for greater efficiency, or investing in automation to reduce labor costs. Some firms might also explore diversifying their sourcing, shifting away from countries facing higher tariffs towards those with more favorable trade terms. These proactive measures can help to lessen the immediate impact on consumer prices.

For example, a clothing retailer might work with new manufacturers in different countries to avoid specific tariffs, or a furniture company might re-engineer its products to use less expensive domestic materials. Over time, supply chains can reorganize, and new markets can emerge, adjusting to the new trade environment. While these adaptations take time and involve initial investment, they are crucial for long-term price stability. Furthermore, advancements in technology, particularly in manufacturing and logistics, can lead to increased efficiencies that help to offset some of the cost pressures from trade policy changes.

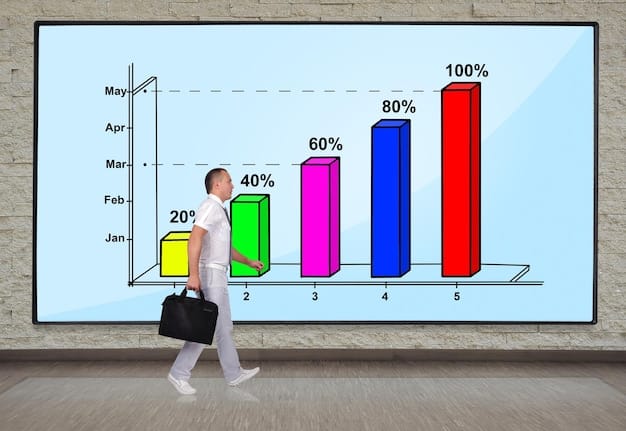

forecasting the 10% price increase

The projection of a potential 10% increase in consumer goods prices is derived from an aggregation of various economic models and supply chain analyses. This figure accounts for the direct costs of tariffs, the indirect costs associated with supply chain restructuring, and the natural market dynamics of producers passing on increased expenses to consumers. It’s an estimate that considers both the initial shock and the trickle-down effect across different economic layers.

methodology behind the projection

Economists and market analysts utilize a combination of quantitative and qualitative methods to arrive at such forecasts. Quantitative methods involve input-output models that track how cost increases in one sector propagate through the economy. This includes analyzing the sensitivity of various industries to imported materials and components. Qualitative assessments involve interviewing industry leaders, reviewing corporate earnings calls, and observing trends in freight and shipping costs. The 10% figure represents an average potential increase, meaning some categories might see more significant jumps, while others experience less.

For example, an analysis might start by identifying the specific goods affected by new tariffs and quantifying their share of overall consumer spending. Then, it estimates the percentage increase in cost for those goods due to tariffs. Beyond direct tariffs, the models consider factors like increased shipping costs due to trade route changes, or higher manufacturing costs if production is reshored to more expensive labor markets. The aggregation of these direct and indirect costs, weighted by their prevalence in consumer spending, leads to the overall 10% projection. This figure also factors in the elasticity of demand for various goods; for essential items, consumers are less likely to reduce consumption, meaning price increases are more easily passed on.

implications for consumers and policymakers

For consumers, the primary implication of these trade policy shifts is the potential for reduced purchasing power and the need to adjust household budgets. Understanding which categories are most affected can help in making informed purchasing decisions. For policymakers, the challenge lies in balancing the intended benefits of trade policy – such as bolstering domestic industries or national security – against the potential for inflationary pressures and their impact on citizens’ daily lives. It requires a delicate calibration of objectives and consequences.

balancing economic goals with consumer welfare

Policymakers often face a complex balancing act. On one hand, trade policies are designed to achieve specific national objectives, such as promoting domestic job growth in strategic sectors or ensuring a stable supply of critical goods. On the other hand, these policies can inadvertently lead to higher prices for everyday items, impacting the cost of living for millions. Finding the ideal equilibrium involves continuous monitoring of economic indicators, public consultation, and willingness to adapt policies based on their real-world effects.

This dynamic tension highlights the ongoing debate within economic circles. Advocates of free trade argue that protectionist measures, while seemingly beneficial to specific domestic industries, ultimately penalize consumers through higher prices and reduced choice. Conversely, proponents of strategic tariffs argue they are necessary tools to counteract unfair trade practices by other nations or to stimulate vital domestic production capabilities for long-term economic resilience. Consumer advocacy groups often play a critical role in bringing the direct impact of these policies on household budgets to the forefront of policy discussions.

| Key Point | Brief Description |

|---|---|

| 📈 Price Hikes Expected | New trade policies could increase consumer goods prices by up to 10%. |

| 🔗 Supply Chain Impact | Tariffs and rules affect import costs and production, leading to higher retail prices. |

| 💡 Consumer Adaptation | Consumers may shift to cheaper alternatives or reduce discretionary spending. |

| ⚖️ Policy Balancing Act | Policymakers weigh domestic benefits against inflationary pressures. |

frequently asked questions

The primary drivers include new tariffs on imported goods, increased costs due to supply chain restructuring, and higher production expenses as companies adjust to new trade policies. These factors combine to elevate the cost of goods for businesses, which are then passed on to consumers.

Sectors highly reliant on global supply chains and imported components, such as electronics, apparel, and certain home goods, are particularly vulnerable. Products like smartphones, clothing, and furniture may see the most noticeable price increases due to changes in tariffs and trade agreements.

Consumers can adopt strategies like opting for generic brands, actively seeking out sales and discounts, or delaying purchases of non-essential big-ticket items. Adjusting spending habits and prioritizing necessities can help manage reduced purchasing power.

While an initial price surge is expected, the long-term outlook depends on various factors. Businesses may adapt by diversifying suppliers or improving efficiencies, and policymakers might adjust policies. Prices could stabilize or even decrease in the future, but it’s not guaranteed.

Supply chain resilience is crucial. Policies aimed at strengthening domestic production or diversifying sourcing can reduce future vulnerabilities to global disruptions. However, these transitions can incur initial costs, contributing to short-term price increases before long-term stability.

conclusion

The recent adjustments to US trade policy mark a significant juncture, with economists and consumers alike anticipating tangible effects on the price of everyday consumer goods. While the projected 10% increase serves as an important benchmark for understanding the potential financial implications, it’s also clear that economic systems are dynamic. Both businesses and policymakers will likely adapt, seeking equilibria that balance national objectives with consumer welfare. Ultimately, staying informed about these evolving trade dynamics will be key to navigating the economic landscape ahead successfully.